The past week can be characterized by its lack of significant economic news,

and there has been no apparent progress in Congress in reaching an agreement on

critical fiscal issues. Economic reports normally produced by the government

are not being released during the shutdown. Without much new information,

mortgage rates ended the week with little change.

As the government shutdown continues, its impact on the mortgage market grows. It is causing some disruptions in the mortgage origination process, and it is limiting the amount of economic data which is released. The Employment report, the most important economic data of the month, did not come out as scheduled on Friday due to the shutdown. Several other significant reports on inflation and economic growth will be postponed as well. This lack of data makes it difficult for investors to get an accurate reading on the performance of the economy.

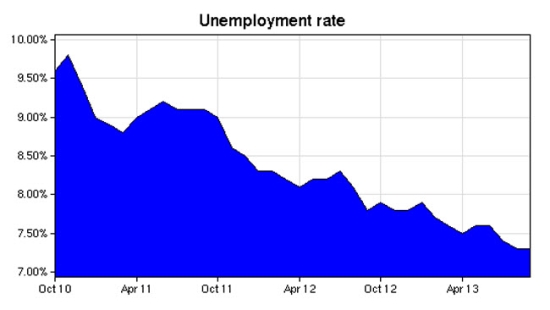

It was announced that President Obama will nominate the Fed's current second in command, Janet Yellen, to be the next Fed Chair when Ben Bernanke's term ends in January. Since Lawrence Summers withdrew from consideration, Yellen has been the clear front runner. Her views are similar to Bernanke's, and she is not expected to make any dramatic changes to current monetary policy. Her statements indicate that she favors loose monetary policy to help reduce the level of unemployment. She is a firm supporter of the Fed's bond buying program, which is favorable for mortgage rates.

Mortgage markets are in a holding pattern as investors wait for a compromise of some sort in Congress to fund the government and to raise the debt ceiling. According to the Treasury, the debt ceiling limit will be reached around October 17. After that, the government will be at risk of defaulting on its obligations, which could cause severe disruptions for the economy and financial markets. A significant deal should reduce the level of uncertainty. A deal which simply postpones the decisions for a short period of time would have a more limited impact.

Information courtesy of Mike A Japhet, NMLS ID# 54723, Originator, Madrona Mortgage, 360-352-0237, mike@madronamortgage.com