Over the past week, two key central bank meetings were

the primary focus for investors. The outcomes of both the European Central Bank

(ECB) and the U.S. Fed meetings were viewed as unfavorable for bonds. As a

result, mortgage rates ended the week higher.

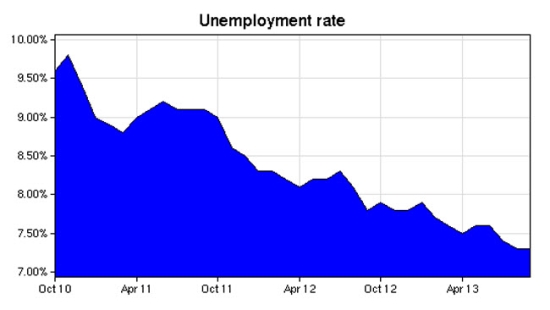

As it had telegraphed to investors for a long time, the Fed raised the federal funds rate by 25 basis points on Wednesday. Less widely anticipated, Fed officials also raised their projections for the pace of rate hikes in 2017 due to quicker expected progress in achieving the Fed's goals for the labor market and inflation. In addition to raising rates, the Fed has stated that it expects to eventually tighten monetary policy by shrinking its investments in Treasuries and mortgage-backed securities (MBS). The faster the Fed raises rates, the sooner it is expected that the Fed will reduce its holdings of MBS, which is negative for mortgage rates.

Ahead of the meeting on December 8, investors generally expected that the ECB would extend its bond purchase program for another six months at its current pace. The ECB exceeded this in one way by extending the program by nine months, meaning that it will now end in December 2017. In a more important area, however, the ECB disappointed investors. The ECB announced that the monthly purchases will decrease from 80 billion euros to 60 billion euros beginning in April. The reduction in the level of stimulus removed some expected future demand for bonds, causing mortgage rates to rise.

Wednesday's data on retail sales was one of the few recent reports on economic activity, which fell short of expectations. Excluding the volatile auto component, retail sales in November rose just 0.2% from October, well below the consensus for an increase of 0.4%, and the results for October were revised lower as well.

Looking ahead, The Consumer Price Index (CPI), a widely followed monthly inflation report, will come out on Thursday. CPI looks at the price change for goods and services that are sold to consumers. The Housing Starts report will be released on Friday, and Existing Home Sales will come out on December 21. In addition, a meeting of the Bank of Japan on December 20 could influence U.S. mortgage rates.

Information originally provided by:

HomeStreet Bank

The Sanders Young Team

NMLS ID #487525 and #438324

HomeStreet Bank

720 Lilly Road SE

Olympia, WA 98501

360-259-2266 Teri/360-250-3799