An appraisal is ordered once the home inspection has been completed and accepted by all parties. An appraisal is required, by the lender and secondary market, to determine the property's market value and is used to verify a property's worth for future financing.

Who ordered it?

- Appraisals are order by the buyer's lender through a 3rd party management company in order to prohibit undue influence and/or pressure to "come up with the number".

What should I do?

- Assist the appraiser's accuracy by being prepared before they arrive:

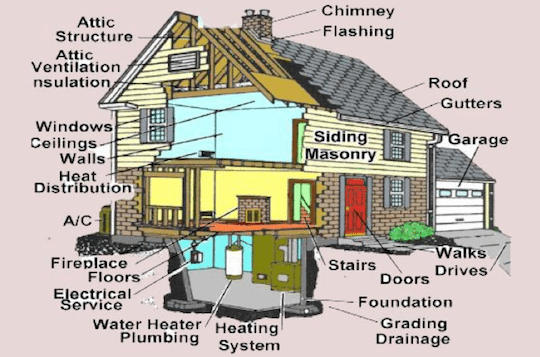

- Make a list of recent updating and/or remodeling as well as the cost. (furnace, roof, siding, appliances, floor covering, etc.)

- Add to the list special features such as sprinklers, heated countertops/floors, security systems, sound systems, etc. that may not be obvious.

- If you are present, make yourself available to answer questions, but give the appraiser a bit of space to do their job. Don't hover!

- Appraisers must state whether kitchen and bathrooms have had significant updating and/or remodeling within 15 years and state the timeframe the work was completed. Be prepared so the appraiser doesn't have to guess.

- Inspect your property during daylight hours.

- Measure the interior and exterior of your home.

- Photography your home inside and out.

- Photograph your carbon monoxide detector (make sure to install it prior to their inspection).

- Inspect the crawl spaces and electrical panel.

- Inspect and photograph all outbuildings (even if they are considered personal property and not included in the value).

- After inspecting your property the appraiser will verify comparable sale and listing data, prepare a written report and send it to the appraisal management company.